Search All Homes in the Lake Norman Area

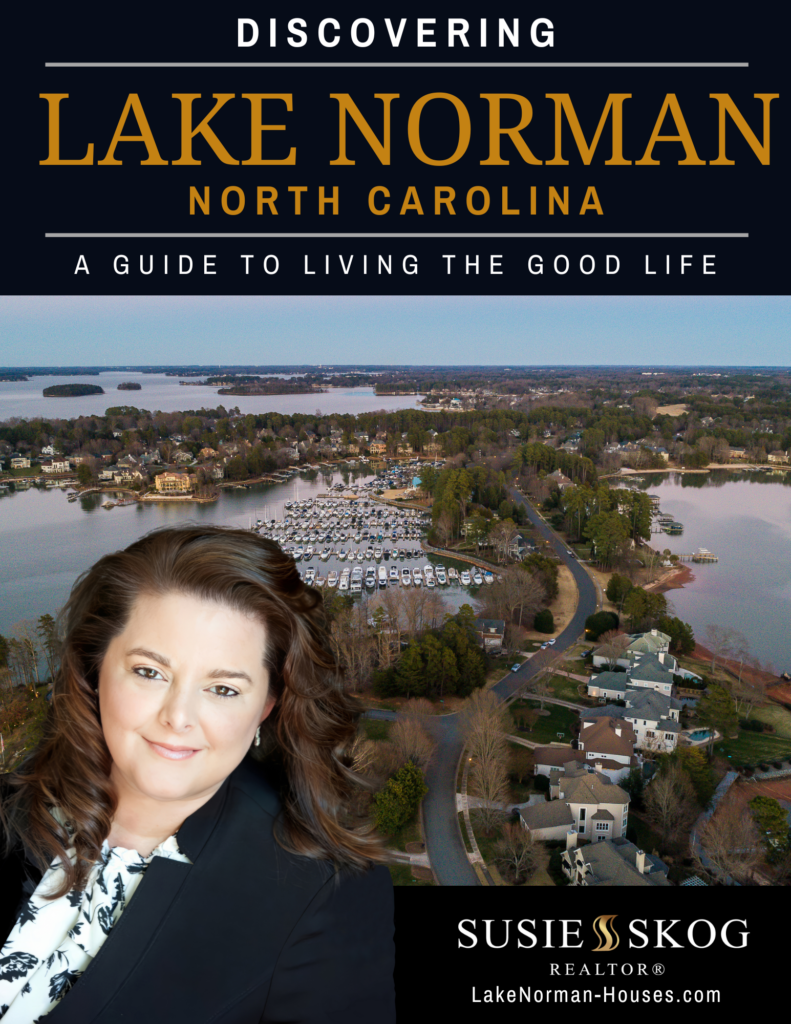

Susie Skog knows Lake Norman Real Estate Inside Out

Looking to buy or sell a home in the picturesque Lake Norman area? Meet Susie Skog, your go-to partner for all your real estate needs. With her wealth of experience, unwavering dedication to clients, and impressive track record, Susie is the perfect ally to help you navigate the Lake Norman real estate scene.

Having lived in the Lake Norman area for over 25 years, Susie has extensive hyper-local knowledge. Her representation of a dynamic real estate portfolio requires discretion and specific expertise.

Susie is a real estate professional with Keller Williams. Susie has earned The Institute for Luxury Home Marketing’s Certified Luxury Home Marketing Specialist™ (CLHMS) designation in recognition of experience, knowledge, and expertise in high-end residential properties. Susie has proven performance in buying and selling high-end homes. She has earned an Accredited Buyer’s Representative (ABR®) Designation, Green Designation, Pricing Strategy Advisor (PSA), and Seniors Real Estate Specialist ® (SRES) Designation, and a certified Online Luxury Marketing Specialist. In addition, Susie is a member of the Keller Williams Sports and Entertainment division.

Whether you’re seeking a bustling urban environment or a peaceful lakeside retreat, Susie will guide you to the perfect location that matches your preferences and needs.

Home Valuation

What Is Your Home Worth?

Listing by Email

Get Daily Listing Email Updates

My Account

Login to Save Listings and Searches

I WANT TO SELL

I WANT TO BUY

Want to Discover and Live the Good Life in Lake Norman, North Carolina?

Grab a FREE copy of Susie Skog’s Exclusive Local’s Guide

Latest News

How to Sell a Home That’s Been on the Market Too Long

When your home sits on the market longer than expected, it can feel discouraging. However, you still have options. In fact, many sellers in Lake Norman face the same challenge. Buyers may have overlooked your home, but that doesn’t mean it won’t sell. With the right...

Marketing a Home to Out-of-State Buyers Moving to Lake Norman

Why Out-of-State Buyers Choose Lake Norman Lake Norman draws many people looking for a new lifestyle. Buyers relocating here often want more space, nature, and a slower pace. The area offers welcoming communities and a variety of homes to fit different needs....

Real Estate Home Tips

4 Tips for Picking the Right Upholstery Fabrics for Your Home

Here are a few tips to help find the right fabric choice for each room in the house.

Style and Aesthetic

From solid colors to vibrant patterns and prints, the hardest part is usually narrowing it down to a fabric that suits your design aesthetic.

Durability

There are certain parts of the home that receive more wear and tear than the rest. In these particular spaces, you may want to opt for a performance fabric.

Care and Cleaning

Take note of any particular cleaning instructions before making a decision.

Tactile Experience

Whether its a silky satin or a plush velvet, your furniture should be finished with a material thats comfortable when sitting or lying down on it.

Published with permission from RISMedia.

5 Improvements That Can Increase Your Home Value

Before you put your home on the market, its important to make sure everythings in tip-top shape in order to maximize value. One of the challenges, however, is knowing which improvements are going to make a difference. Here are five updates that buyers are willing to shell out a little extra cash for.

Updated Kitchen

The kitchen is the heart of the home, and it can often make or break how buyers feel about a residence. You dont have to undergo a top-to-bottom remodel before listing your house, but upgrading your appliances and replacing dated countertops can transform your cooking space.

Outdoor Living

High-end buyers are looking for homes with outdoor spaces where they can both enjoy family time and entertain. If your patio or deck is looking a bit tired, you can make it more appealing by adding a fire pit or barbecue area where people can envision themselves hanging out.

Eco-Friendly Features

Spend a little more money to make your home eco-friendly and youll surely see a return on your investment. Energy-efficient windows and appliances have major appeal to buyers who are looking to lower their impact on the environment while also lowering their utility bills.

Well-Appointed Bathrooms

If you want your home to fetch top dollar, you better have luxurious bathrooms. High-quality fixtures for the sinks, showers and baths are a must. It doesnt have to be a total overhaul, but refreshing the bathrooms with new tiles and countertops can go a long way in the eyes of potential buyers.

Curb Appeal

You only have one chance to make a first impression. When buyers arrive at your home, theyre going to have formed an opinion before they even step inside. A new front porch or walkway can pay off when its time to sell your home.

If youd like more insight into how to get your home ready to sell, Id be happy to discuss further and provide you with personalized advice for your property.

Published with permission from RISMedia.

Featured Communities

Insights & Trends

Picking Out the Right Upholstery Fabrics for Your Home

If youre the type who likes to get hands-on with...

How to Design a Statement Ceiling

For the hottest new trend in luxury home design,...

4 Great Surfaces for Outdoor Kitchen Counters

Having an outdoor area where the whole family...